Better Customer Onboarding

Relay’s feed technology is proven to help banks and credit unions drive more account funding, more card activations, and more digital adoption from day 1.

Higher Open Rate X Better Conversion Rate = Business Outcomes

Relay’s personalized feeds drive better business outcomes for financial institutions by improving and accelerating activation and onboarding.

new account funding

per active account

app logins

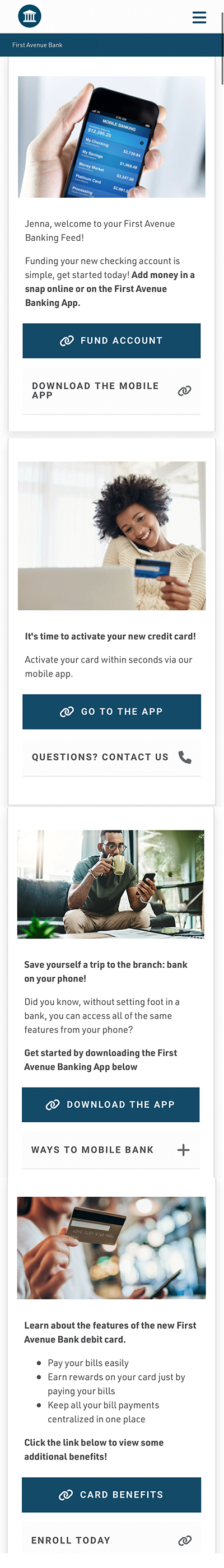

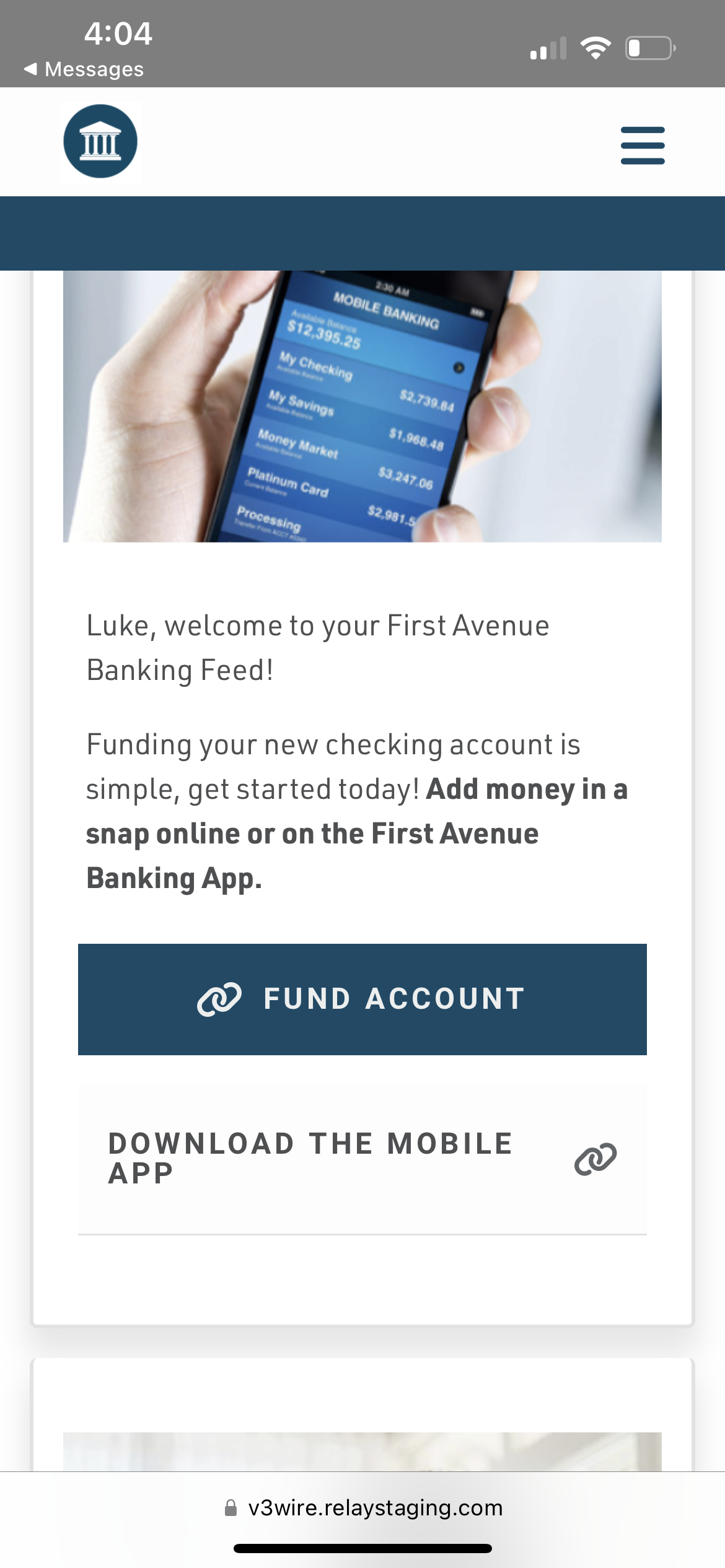

Account Funding

Using Relay Feed Technology, our clients saw as high as 90% lift in new account funding on all of their digitally-originated accounts.

Account Funding

Using Relay Feed Technology, our clients saw as high as 90% lift in new account funding on all of their digitally-originated accounts.

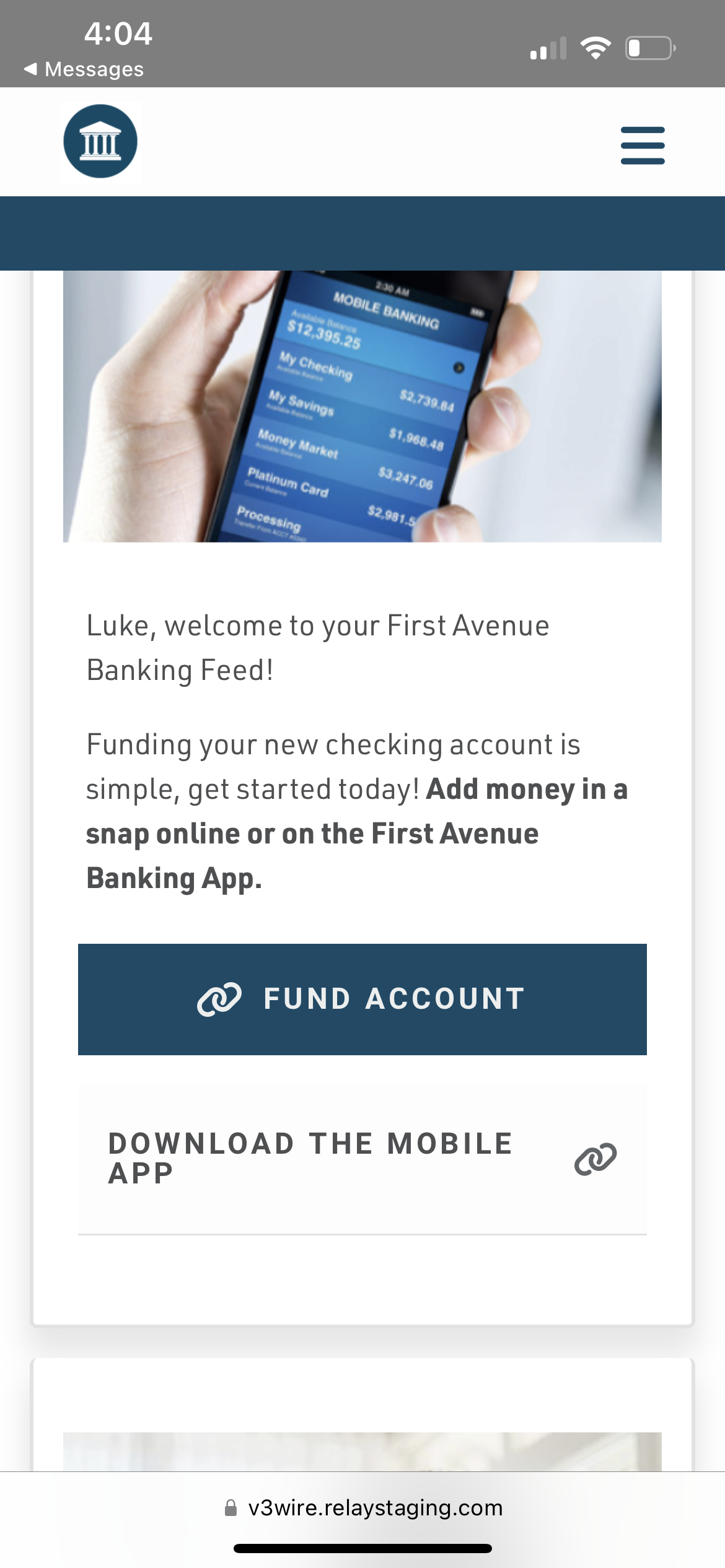

Card Activation

When onboarding using Relay Customer Feeds, financial institutions catalyze customers to action and educate them on account features and perks.

Using our technology, clients can see up to an 88% increase in debit card activation rates within days of opening.

Digital Adoption

We understand you have made significant investments in your app, portal, email campaigns, and more. That is why financial institutions use Relay to encourage downloads of your app, registrations for your portal, paperless statements, autopay, and mobile deposits.

Clients typically see a 43% increase in mobile app logins using our feeds.

Usage of Products & Services

Our clients utilize feeds to educate customers on products and services like loan draws, debit cards, and direct deposits.

Relay clients typically see a 10% increase in spend per active account.

Top Banks & Credit Unions Choose Relay

Drive Deposits,

Spend, and Loyalty

Spend, and Loyalty

Relay clients in banking typically see…

46% lift in account funding

39% increase in direct deposit enrollment

12% increase in pull-through for home equity line of credit applications

30% lift in click through rates during account activation

41% increase in mobile deposits

Want To See It In Action? Get a Sample Feed.

Give us your details and we will send you a sample feed in seconds right to your phone.